New Hybrid Cloud Reseller Relationship with IBM and Continued Managed Service Provider Adoption

- Developed new strategic reseller relationship with IBM, creating new joint solutions that enable hybrid cloud data migration, backup, and restore for IBM Power Virtual Server Cloud (IBM Power VS) clients and MSPs that will be resold with IBM Cloud sales force and partner channels

- Added four new MSP partners for the StorSafe secure backup-as-a-service solution while existing MSP partners expanded their business to protect new customers and systems, aligned with the FalconStor strategic shift to serve the MSP community

- Rolled out new initiatives with Hitachi Vantara to build pipeline for advanced disaster recovery and cloud-enabled protection that will be resold by Hitachi Vantara sales force and partner channels

AUSTIN, TEXAS (May 11, 2022) – FalconStor Software, Inc. (OTCQB: FALC), a trusted data protection leader modernizing disaster recovery and backup for the hybrid cloud world, today announced financial results for its first quarter 2022, which ended on March 31, 2022.

“Our strategic shift to recurring revenue-based hybrid cloud data protection solutions took a material step forward in the quarter as we worked aggressively to secure an important reseller relationship with IBM,” said Todd Brooks, FalconStor CEO. “IBM’s cloud push has been a centerpiece of its corporate strategy, as highlighted in its first quarter 2022 results. As we announced earlier today, enterprises can now leverage new joint hybrid cloud solutions from FalconStor and IBM. These solutions are especially important to the tens of thousands of companies around the globe that leverage IBM i environments, as they now have the ability to securely backup and restore to the cloud as well as migrate their IBM i workloads to IBM Power VS Cloud with secure backup and recovery on an on-going basis.”

“Despite the importance of this step forward in our efforts to reinvent FalconStor, our aggressive focus on advancing critical hybrid cloud relationships and our efforts to realign our sales team accordingly negatively impacted our legacy on-premises expansions and legacy on-premises new customer acquisition revenue during the quarter. We don’t view our poor legacy results in Q1 as being a signal of accelerated legacy decline in the future,” stated Brooks. “In fact, legacy recurring revenue renewal rates were 86% and ARR increased 4% year-over-year during the quarter. As we continue to reinvent FalconStor, we must simultaneously focus on driving new strategic hybrid cloud ARR growth and maintaining a solid legacy on-premises revenue base.”

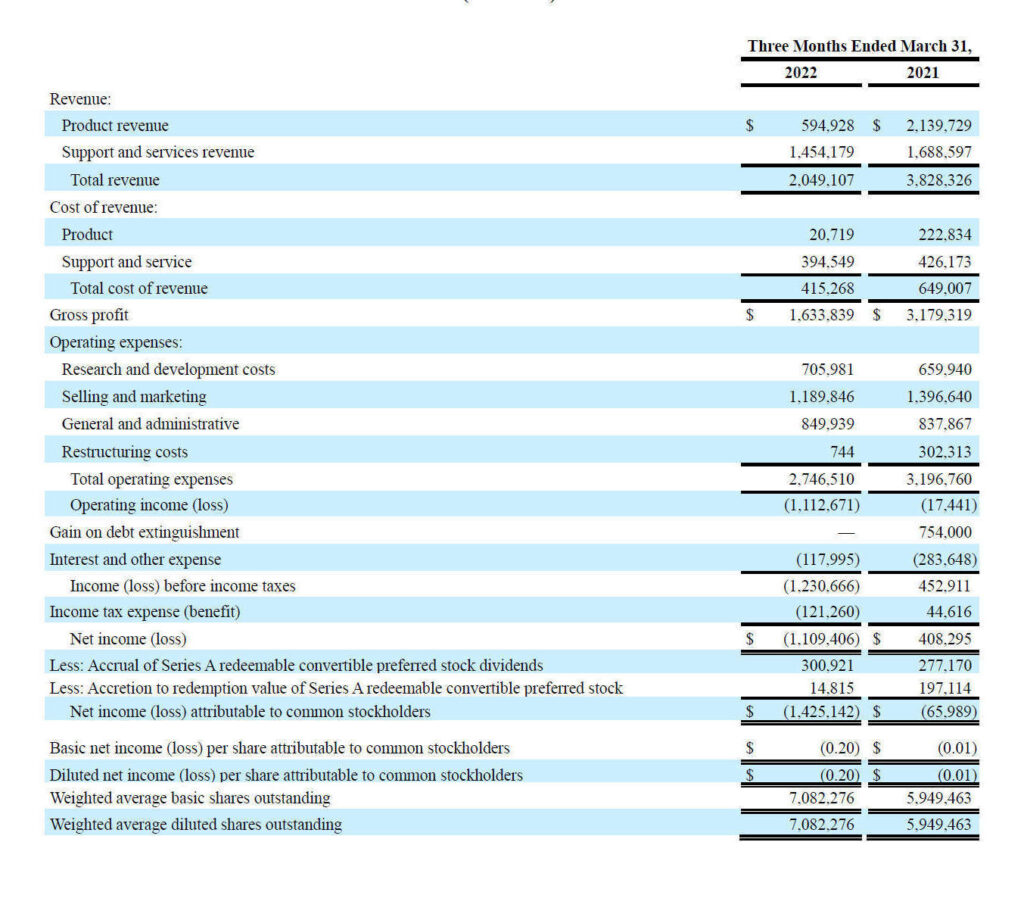

First Quarter 2022 Financial Results

- Annual Recurring Revenue (ARR): 4% year-over-year growth

- Ending Cash: $3.4 million, compared to $2.0 million in the first quarter of fiscal year 2021

- Total Revenue: $2.0 million, compared to $3.8 million in the first quarter of fiscal year 2021

- Total Cost of Revenue: $0.4 million, compared to $0.6 million in the first quarter of fiscal year 2021

- Total Operating Expenses: $2.7 million, compared to $3.2 million in the first quarter of fiscal year 2021

- GAAP Net Income (Loss): $(1.1) million, compared to $0.4 million in the first quarter of fiscal year 2021

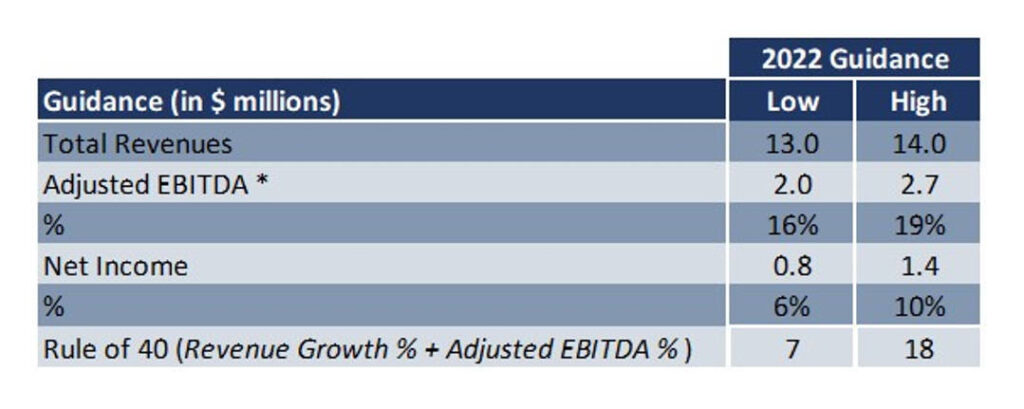

Guidance

Given Q1 2022 results, we are reducing full-year guidance as follows:

Conference Call and Webcast Information

WHO: Todd Brooks, Chief Executive Officer, FalconStor and Vincent Sita, Chief Financial Officer, FalconStor

WHEN: Wednesday, May 11, 2022, 4:00 PM Central; 5:00 PM Eastern

HOW: Watch the webcast at:

FALCONSTOR FIRST QUARTER 2022 FINANCIAL TELECONFERENCE AND PRESENTATION

As an alternative, you can copy and paste the following link into your web browser to register:

https://register.gotowebinar.com/register/4946665852509096204

Conference Call:

Please dial the following if you would like to interact with and ask questions to FalconStor hosts:

Toll Free: 877-568-4108

Access Code: 399-172-649

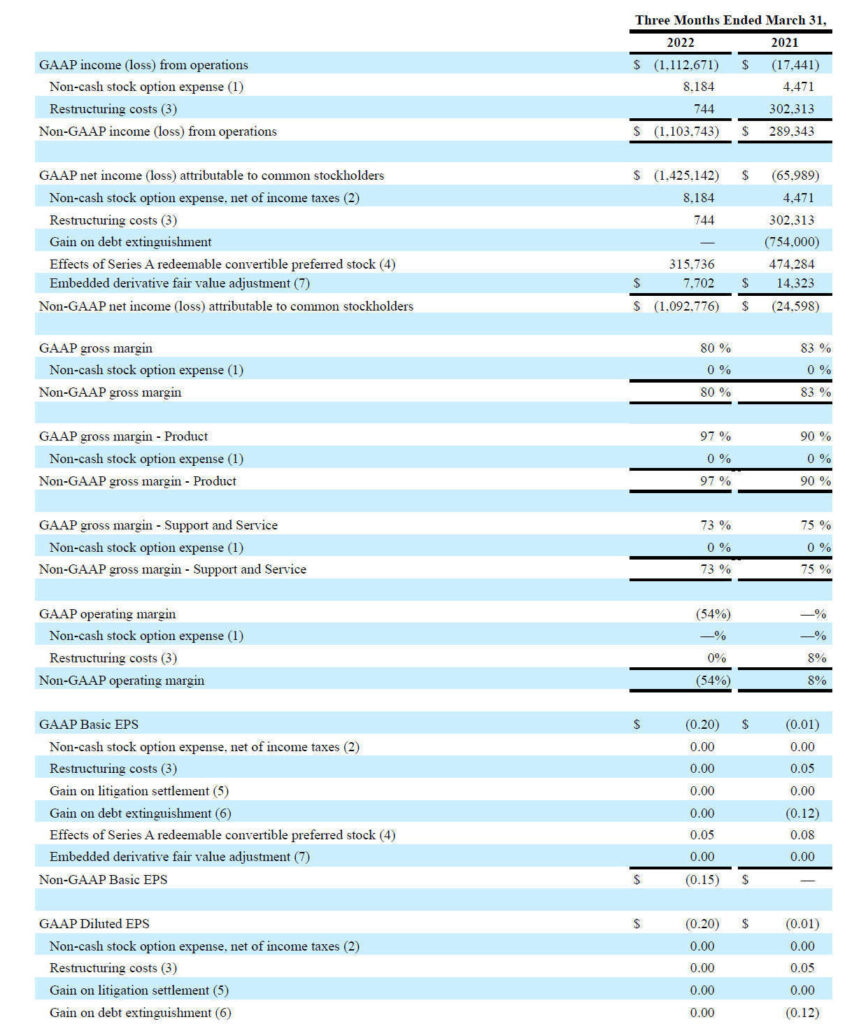

Non-GAAP Financial Measures

The non-GAAP financial measures used in this press release are not prepared in accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. The Company’s management refers to these non-GAAP financial measures in making operating decisions because they provide meaningful supplemental information regarding the Company’s operating performance. In addition, these non-GAAP financial measures facilitate management’s internal comparisons to the Company’s historical operating results and comparisons to competitors’ operating results. We include these non-GAAP financial measures (which should be viewed as a supplement to, and not a substitute for, their comparable GAAP measures) in this press release because we believe they are useful to investors in allowing for greater transparency into the supplemental information used by management in its financial and operational decision-making. The non-GAAP financial measures exclude (i) restructuring costs, (ii) effects of our Series A redeemable convertible preferred stock, and (iii) non-cash stock-based compensation charges and any potential tax effects. For a reconciliation of our GAAP and non-GAAP financial results, please refer to our reconciliation of GAAP to Non-GAAP financial measures presented in this release.

About FalconStor Software

FalconStor is the trusted data protection software leader modernizing disaster recovery and backup operations for the hybrid cloud world. The Company enables enterprise customers and managed service providers to secure, migrate, and protect their data while reducing data storage and long-term retention costs by up to 95%. More than 1,000 organizations and managed service providers worldwide standardize on FalconStor as the foundation for their cloud first data protection future. Our products are offered through and supported by a worldwide network of leading managed service providers, systems integrators, resellers, and original equipment manufacturers.

# # #

FalconStor and FalconStor Software are trademarks or registered trademarks of FalconStor Software, Inc., in the U.S. and other countries. All other company and product names contained herein may be trademarks of their respective holders.

Links to websites or pages controlled by parties other than FalconStor are provided for the reader’s convenience and information only. FalconStor does not incorporate into this release the information found at those links nor does FalconStor represent or warrant that any information found at those links is complete or accurate. Use of information obtained by following these links is at the reader’s own risk.

CONTACT INFORMATION

For more information, contact:

Vincent Sita

Chief Financial Officer

FalconStor Software Inc.

investorrelations@falconstor.com

Corporate Headquarters

501 Congress Avenue

Suite 150

Austin, Texas 78701

Tel: +1.631.777.5188

salesinfo@falconstor.com

Europe Headquarters

GERMANY

Landsberger Straße 302

80687 München, Germany

salesemea@falconstor.com

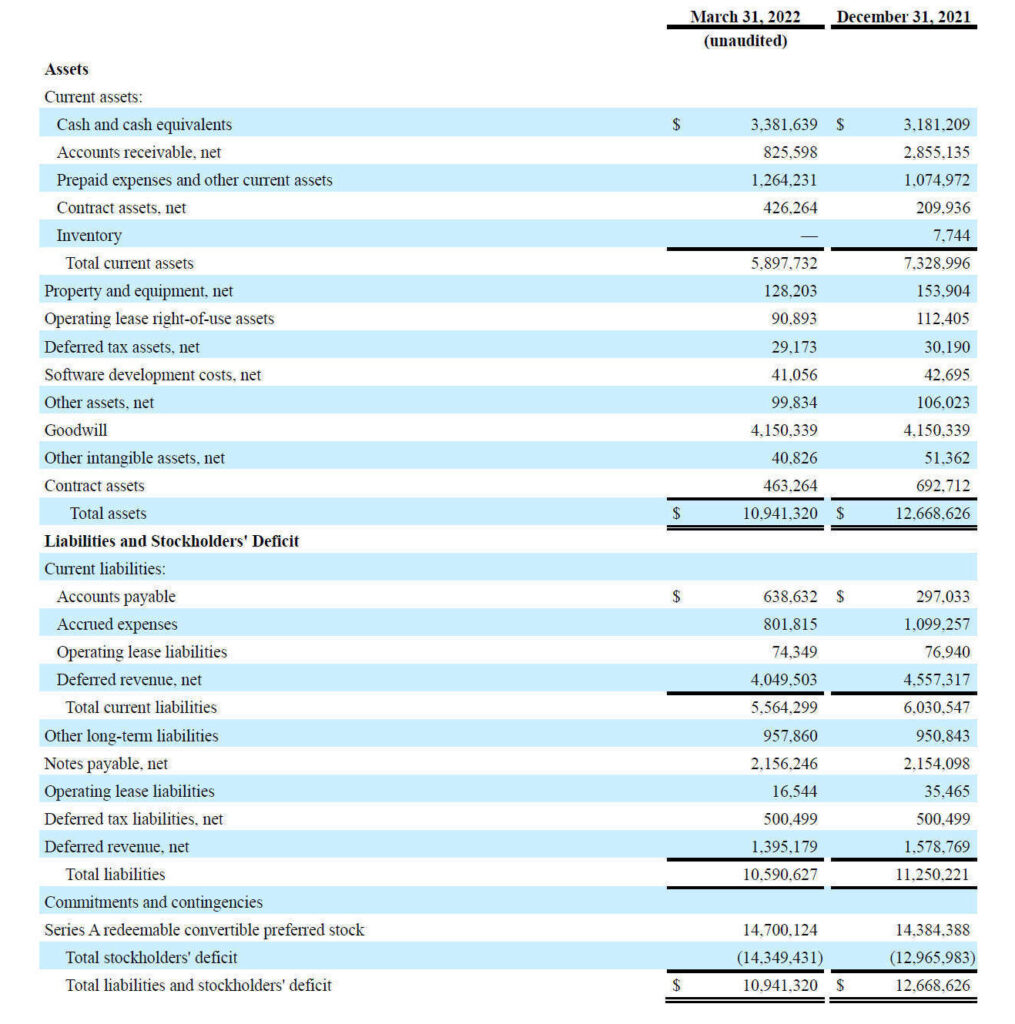

FalconStor Software, Inc. and Subsidiaries

CONDENSED CONSOLIDATED BALANCE SHEETS

FalconStor Software, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

FalconStor Software, Inc. and Subsidiaries

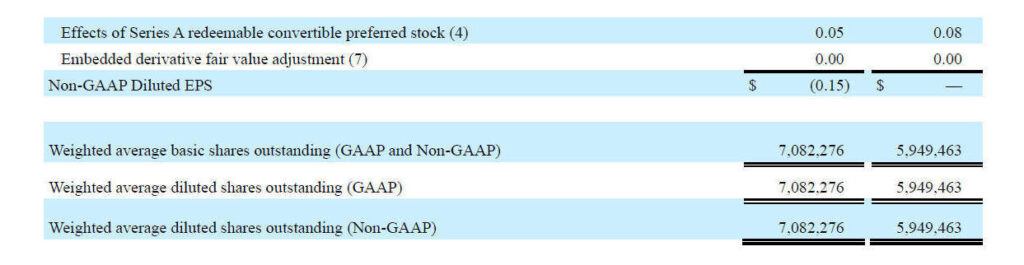

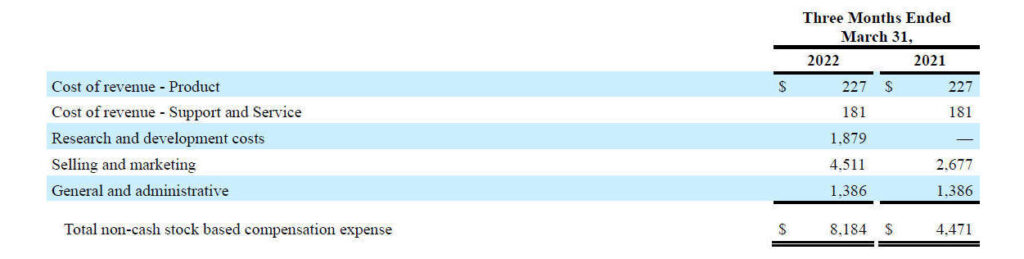

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited)

Footnotes:

(1) Represents non-cash, stock-based compensation charges as follows:

(2) Represents the effects of non-cash stock-based compensation expense recognized, net of related income tax effects. For the three months ended March 31, 2022 and 2021, the tax expense for both GAAP and Non-GAAP basis approximate the same amount.

(3) Represents restructuring costs which were incurred during each respective period presented.

(4) Represents the effects of the accretion to redemption value of the Series A redeemable convertible preferred stock, accrual of Series A redeemable convertible preferred stock dividends and deemed dividend on Series A redeemable convertible preferred stock.

(5) Represents a gain for the legal settlement of a contractual dispute with a marketing/sales firm.

(6) Represents the gain recorded when the Company’s loan with the Paycheck Protection Program under the Coronavirus Aid, Relief, and Economic Security Act was forgiven on March 30, 2021.

(7) Represents the income statement (gain) or loss resulting from the change in fair value of our embedded derivative liability associated with the Company’s Series A redeemable convertible preferred stock.